Medicare and You: Maximizing Benefits for a Healthy Retirement

Embarking on retirement brings a new set of considerations, especially when it comes to healthcare. Understanding the intricacies of Medicare Parts A, B, C, and D is essential for maximizing benefits and ensuring a healthy retirement. Access Health Care Physicians, LLC, is here to guide you through the process, helping you make informed decisions that align with your unique needs.

1. Introduction to Medicare in Retirement

Retirement marks a significant chapter in life, and securing the right healthcare coverage is pivotal. Medicare, a federal health insurance program, becomes a cornerstone for seniors aged 65 and older, providing comprehensive coverage for various healthcare needs.

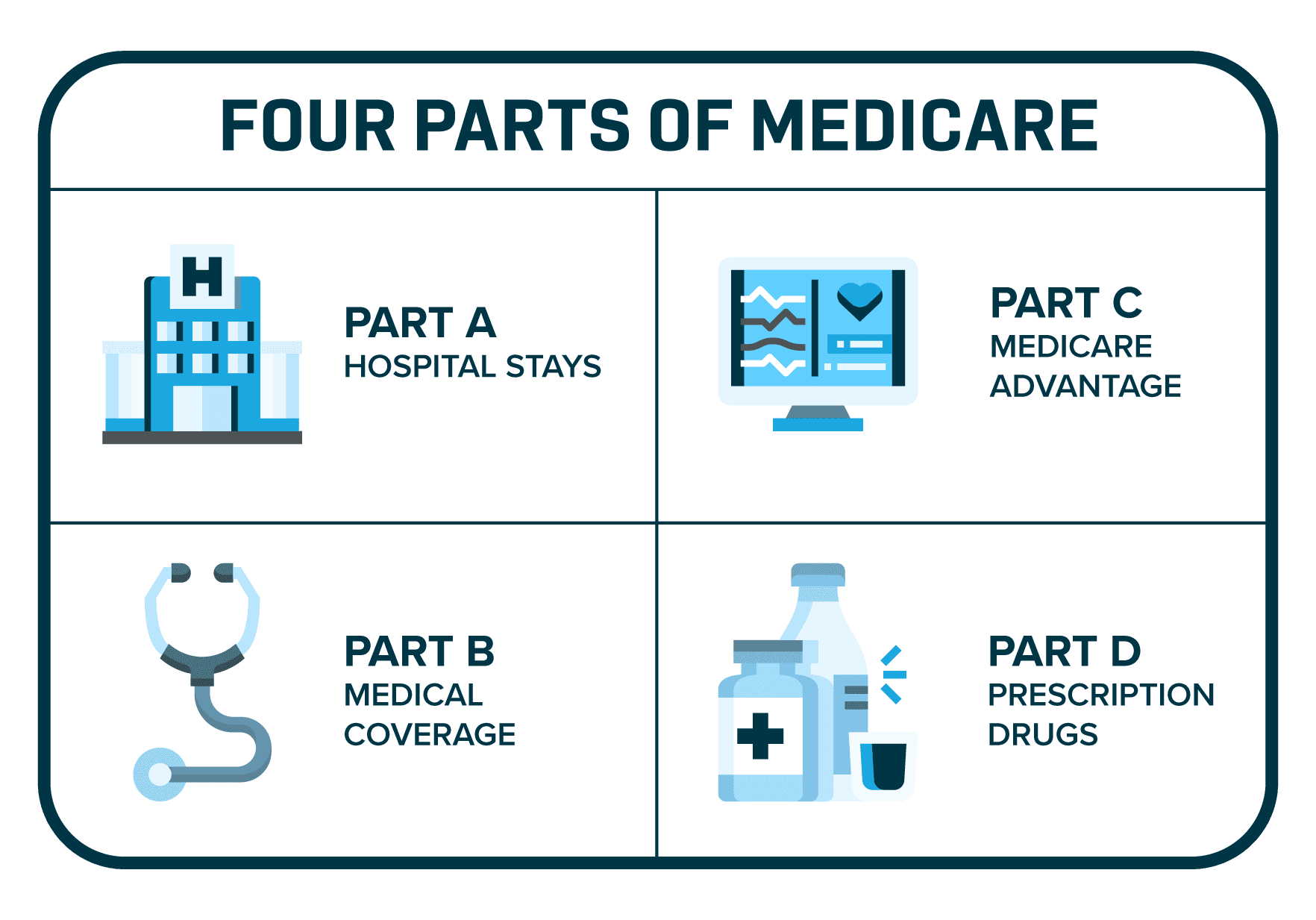

2. Unpacking Medicare Parts A, B, C, and D

2.1 Medicare Part A: Hospital Insurance

Part A covers inpatient hospital stays, skilled nursing facility care, hospice care, and some home health care services. Seniors can maximize benefits by understanding the full scope of hospital-related coverage.

2.2 Medicare Part B: Medical Insurance

Part B focuses on outpatient care, doctor visits, ambulance services, and preventive screenings. Maximizing benefits involves leveraging the extensive medical coverage offered under Part B.

2.3 Medicare Part C: Advantage Plans

Medicare Part C, or Advantage Plans, provides an alternative to Original Medicare, often including vision, dental, and prescription drug coverage. Seniors can explore how Advantage Plans align with their specific healthcare preferences.

2.4 Medicare Part D: Prescription Drug Coverage

Part D is dedicated to prescription drug coverage, either standalone or included in Medicare Advantage Plans. Maximizing benefits includes actively enrolling in Part D to offset medication costs and ensure access to necessary treatments.

3. Strategies for Maximizing Medicare Benefits

3.1 Early Enrollment for Timely Coverage

Enrolling in Medicare during the Initial Enrollment Period ensures timely coverage, preventing gaps in healthcare protection and potential late enrollment penalties.

3.2 Choosing Between Original Medicare and Medicare Advantage

Seniors can maximize benefits by carefully weighing the choice between Original Medicare and the comprehensive coverage of Medicare Advantage. Understanding personal preferences and healthcare needs is crucial in making this decision.

3.3 Supplementing with Medigap for Extra Coverage

For those selecting Original Medicare, supplementing with Medigap policies offers additional coverage. This strategy ensures seniors are protected against unexpected healthcare costs.

3.4 Tailoring Coverage with Part D

Actively enrolling in Part D aligns with maximizing benefits, as it guarantees access to prescription drug coverage and prevents potential penalties for late enrollment.

3.5 Expert Guidance from Access Health Care Physicians, LLC

Access Health Care Physicians, LLC, provides seniors with expert guidance and personalized assistance, ensuring they navigate the complexities of Medicare with confidence. Our team is dedicated to helping you make choices aligned with your retirement healthcare goals.

4. FAQs About Maximizing Medicare Benefits in Retirement

4.1 Can I enroll in Medicare if I have retiree health coverage?

Yes, individuals with retiree health coverage can enroll in Medicare. It's crucial to understand coordination between the two for seamless healthcare transition.

4.2 How do Medicare Advantage Plans enhance retirement healthcare?

Medicare Advantage Plans can enhance retirement healthcare by offering comprehensive coverage, including services not covered by Original Medicare.

4.3 What's the significance of reviewing the drug formulary in Part D?

Reviewing the drug formulary is crucial to ensuring that Part D covers prescribed medications, preventing unexpected costs and ensuring access to necessary drugs.

4.4 Can I change my Medicare plan after retirement?

Yes, seniors have the flexibility to make changes to their Medicare plans during the Annual Enrollment Period, adapting coverage to evolving healthcare needs.

4.5 How does Medigap provide additional coverage for seniors?

Medigap policies provide additional coverage by filling gaps in Original Medicare, offering financial protection against out-of-pocket expenses.

Conclusion

In conclusion, maximizing Medicare benefits for a healthy retirement involves a strategic approach to understanding and selecting the right coverage. Access Health Care Physicians, LLC, is dedicated to supporting seniors in this journey, offering expert guidance and personalized assistance. By comprehensively exploring Medicare Parts A, B, C, and D, seniors can make informed decisions, ensuring they enjoy a retirement filled with good health and peace of mind.

.png)

Comments

Post a Comment